The Leader in Supply Chain Automation

30+ years

leading industry innovation

ANNUAL FREIGHT SPEND

MOBILE DOWNLOADS

FLEETS SERVED

Connected technologies to drive actionable insights

IMPROVE CASH FLOW. REDUCE COSTS.

BOOST EFFICIENCY.Our interconnected suite of logistics management software solutions has everything you need for real-time communication and seamless operations.

Driver workflow

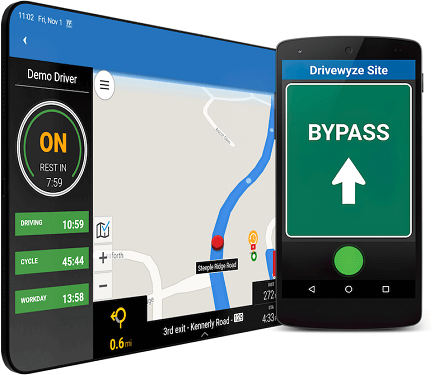

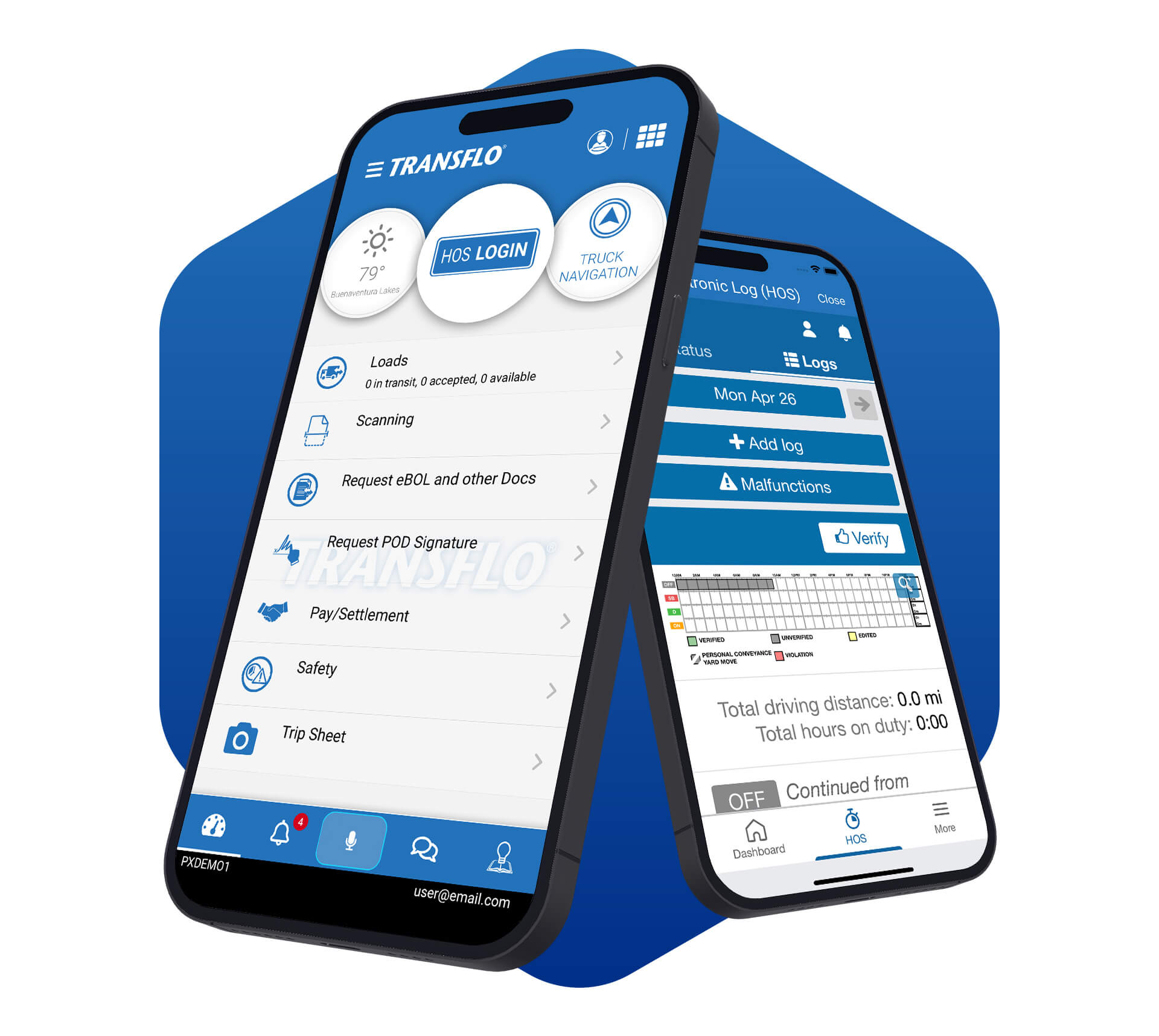

FOR DRIVERS

One central app for drivers to complete their journey.

Learn about Transflo Mobile+

Fleet automation

FOR THE FLEET

Go beyond HOS with a platform that provides full visibility into your fleet.

Learn about Telematics & ELD

Back-office automation

FOR THE OFFICE

Increase efficiency and reduce up to 97% of paperwork through automation.

Learn about Workflow AI

Partners & integrations

ACROSS THE SUPPLY CHAIN

Integrate seamlessly with existing platforms or discover insightful new use cases to drive business forward.

Learn about Partners & integrationsSolutions for every link within the supply chain

A complete ecosystem of logistics management software solutions to manage drivers, loads, routes, documentation, and more.

-

Transflo Mobile+

Mobile app for drivers. -

Telematics & ELD

Compliance and fleet tracking. -

Synergize

Customized document management. -

Transflo Express

Truckstop scanning.

Intelligent automated solutions which streamline your invoicing, communications, and load tracking.

-

Workflow AI

Back office automation. -

Transflo Wallet

Digital payments & fuel advance. -

Velocity+

Seamless logistics management.

Operational automation that removes time-consuming manual tasks from your operations.

-

Workflow AI

Back office automation.

Connected software that promotes efficiency from fulfillment to delivery.

-

Transflo Mobile+

Mobile app for drivers. -

Telematics & ELD

Compliance and fleet tracking. -

eBOL & ePOD

Paper-free BOL and POD.

Delivering a truckload of benefits

Connect to your TMS

Seamlessly integrate our logistics management software with your existing systems for efficient operations and data flow.

Increase speed to billing

Expedite invoicing processes for faster payment turnaround and improved cash flow.

Reduce costs

Lower operational expenses by automating processes and improving efficiency.

Track everything

Easily monitor payments, loads, and more with intuitive tracking capabilities.

Gain complete visibility

See exactly what’s happening in real time with every shipment and delivery.

Reduce paperwork

Minimize time-intensive manual tasks and paperwork for greater productivity.

Enhance safety

Promote safer driving practices and mitigate risks with safety-focused features.

Simplify compliance

Manage compliance with easy-to-use tools, alerts, and streamlined processes.